Canada's Fiscal Challenges: A Path Towards Responsible Governance

Table of Contents

The Growing National Debt and Deficit

Understanding the difference between national debt and deficit is paramount. The national debt represents the accumulated total of past government borrowing, while the deficit reflects the shortfall between government spending and revenue in a single year. Canada currently faces a substantial national debt, significantly impacting its fiscal health. This is fueled by several interconnected factors. Increased government spending on crucial areas like healthcare and social programs, necessary to maintain Canada's social safety net, contributes significantly. Furthermore, economic downturns, such as the recent COVID-19 pandemic, necessitate increased government spending and reduce tax revenue, exacerbating the deficit and adding to the overall debt.

- Statistics on Canada's national debt-to-GDP ratio: The debt-to-GDP ratio provides a crucial benchmark for assessing fiscal sustainability. A high ratio indicates a greater burden on the economy. [Insert current statistics here, citing reputable sources like Statistics Canada].

- Breakdown of government spending by sector: A detailed analysis of government spending reveals where the largest expenditures are allocated, highlighting areas for potential efficiency improvements. [Include a breakdown with percentages, citing sources].

- Analysis of tax revenue trends: Examining trends in tax revenue helps identify potential areas for adjustments or reforms to ensure a sustainable revenue stream for the government. [Include data on tax revenue from various sources, citing sources].

The Impact of Aging Population on Fiscal Sustainability

Canada's aging population presents a significant long-term fiscal challenge. As the proportion of seniors increases, the demand for healthcare services and pension payments rises dramatically, placing a substantial strain on government budgets. This demographic shift necessitates proactive planning and policy adjustments to ensure the long-term viability of these crucial social programs.

- Projected growth of the senior population in Canada: Statistics Canada projects a substantial increase in the senior population over the coming decades. [Include specific projections and cite the source].

- Cost projections for healthcare and pensions: The cost of providing healthcare and pension benefits to an aging population is projected to increase significantly. [Include cost projections and cite reputable sources].

- Potential policy options for mitigating the impact: Several strategies can help mitigate the impact, including pension reform, optimizing healthcare delivery, and encouraging immigration to maintain a strong workforce. [Discuss potential policy options, highlighting their pros and cons].

Revenue Generation and Tax Policy

The Canadian tax system plays a crucial role in generating revenue to fund government programs and services. Analyzing its effectiveness and exploring potential reforms is essential for addressing Canada's fiscal challenges. This includes considering various tax policy options, such as adjustments to the carbon tax or corporate tax rates.

- Comparison of Canada's tax rates with other developed nations: Comparing Canada's tax rates with those of other developed nations provides context for assessing the competitiveness of the Canadian tax system. [Include a comparative table with data from reputable sources].

- Pros and cons of potential tax reform options: Each potential tax reform has its own set of advantages and disadvantages, which need to be carefully considered in terms of economic impact and social equity. [Discuss the potential impacts of different tax reforms].

- Analysis of the impact on different income groups: Tax reforms must be carefully designed to avoid disproportionately impacting certain income groups. [Analyze the potential distributional effects of various tax policies].

Improving Government Efficiency and Spending

Improving government efficiency and streamlining spending are crucial for addressing Canada's fiscal challenges. Identifying areas where government spending can be optimized without compromising essential services is key.

- Examples of government programs that could be reformed: Several government programs may benefit from reform to enhance efficiency and effectiveness. [Provide examples and suggest potential improvements].

- Strategies for improving efficiency in government operations: Implementing technological advancements and streamlining administrative processes can contribute significantly to cost savings. [Suggest strategies for improving efficiency].

- Potential cost savings through technology adoption: Adopting innovative technologies can significantly reduce administrative costs and improve service delivery. [Provide examples of technological advancements and their potential cost savings].

Promoting Economic Growth and Diversification

Strong economic growth is essential for alleviating fiscal pressures. Diversifying the Canadian economy and fostering innovation are crucial for creating high-paying jobs and attracting foreign investment.

- Key sectors for economic growth in Canada: Identifying and supporting key sectors for economic growth, such as clean technology, advanced manufacturing, and digital technologies, is vital. [Identify key sectors and discuss strategies for supporting their growth].

- Policies to support innovation and entrepreneurship: Policies that encourage innovation and entrepreneurship are crucial for long-term economic growth and job creation. [Discuss policies that promote innovation].

- Strategies to attract foreign investment: Attracting foreign investment is crucial for stimulating economic growth and diversifying the Canadian economy. [Discuss strategies to attract foreign investment].

Conclusion: A Path Forward for Canada's Fiscal Challenges

Canada's fiscal challenges are significant and require a multifaceted approach. Addressing the growing national debt, mitigating the impact of an aging population, reforming tax policies, improving government efficiency, and promoting economic growth are all critical components of a sustainable fiscal strategy. Responsible governance demands proactive measures to ensure long-term economic stability and prosperity. We urge readers to engage in informed discussions about Canada's fiscal future, advocating for policies that effectively address Canada's fiscal challenges and promote responsible governance. Contact your elected officials and participate in the public discourse surrounding these crucial issues to help shape a sustainable fiscal path for Canada.

Featured Posts

-

Celebrities Affected By The La Palisades Fires A Comprehensive List Of Home Losses

Apr 24, 2025

Celebrities Affected By The La Palisades Fires A Comprehensive List Of Home Losses

Apr 24, 2025 -

The Bold And The Beautiful April 9 Recap Steffy Blames Bill Finn In Icu Liams Demand For Secrecy

Apr 24, 2025

The Bold And The Beautiful April 9 Recap Steffy Blames Bill Finn In Icu Liams Demand For Secrecy

Apr 24, 2025 -

Pope Francis Papacy Global Reach And Internal Divisions

Apr 24, 2025

Pope Francis Papacy Global Reach And Internal Divisions

Apr 24, 2025 -

Ella Travolta Kci Johna Travolte Odrasla U Prekrasnu Zenu

Apr 24, 2025

Ella Travolta Kci Johna Travolte Odrasla U Prekrasnu Zenu

Apr 24, 2025 -

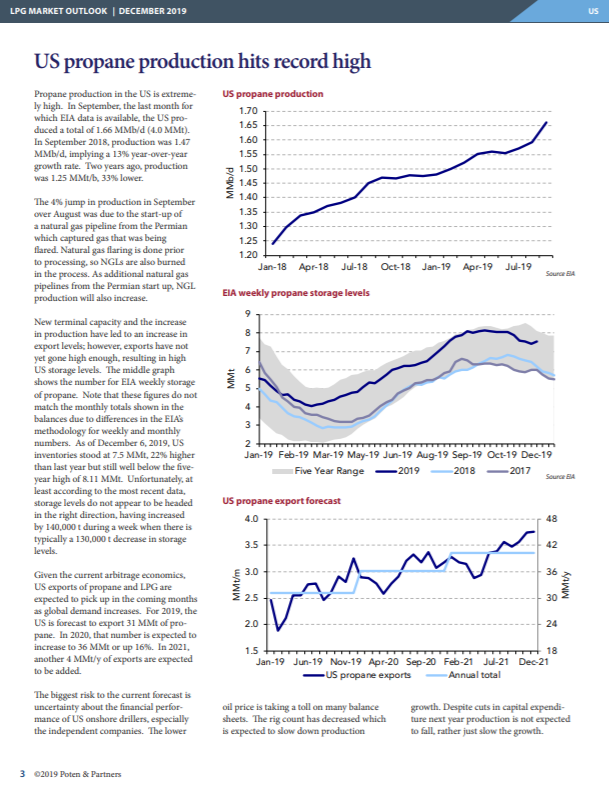

The Changing Landscape Of Chinas Lpg Market From Us To Middle East

Apr 24, 2025

The Changing Landscape Of Chinas Lpg Market From Us To Middle East

Apr 24, 2025