Canada's Economic Outlook: The Need For Fiscal Responsibility

Table of Contents

Canada's economic future hinges on a crucial factor: fiscal responsibility. While the country boasts a strong economy in many respects, looming challenges necessitate a careful and strategic approach to government spending and debt management. This article examines the current economic landscape and argues for a renewed commitment to fiscal responsibility to ensure long-term prosperity and stability for all Canadians. The need for fiscal responsibility in Canada is paramount for navigating the complex economic currents ahead.

H2: Current State of the Canadian Economy

H3: Strengths of the Canadian Economy:

Canada's economy possesses several significant strengths. These positive indicators contribute to a generally optimistic, though cautious, outlook.

- Strong Natural Resource Sector: Canada's abundant natural resources, including oil, gas, minerals, and timber, continue to be a major contributor to GDP. The recent rise in global commodity prices has boosted this sector. (Source: Statistics Canada) Keywords: Canadian economic growth, natural resource economy.

- Resilient Labor Market: Despite global economic uncertainty, Canada's job market has shown remarkable resilience, with relatively low unemployment rates in recent years. (Source: Statistics Canada) Keywords: job market Canada.

- Innovation and Technology: Canada is a global leader in certain technological sectors, fostering innovation and attracting foreign investment. This contributes to long-term economic diversification.

These strengths provide a solid foundation, but they are not without challenges. The reliance on the natural resource sector, for example, leaves the Canadian economy vulnerable to global commodity price fluctuations. Continued investment in diversification is crucial.

H3: Challenges Facing the Canadian Economy:

Several significant headwinds threaten Canada's economic stability and necessitate a renewed focus on fiscal responsibility in Canada.

- Inflation: Canada, like many other countries, is grappling with persistent inflation, eroding purchasing power and impacting consumer spending. (Source: Bank of Canada) Keywords: inflation Canada.

- High Interest Rates: The Bank of Canada has implemented interest rate hikes to combat inflation, increasing borrowing costs for businesses and consumers. This can slow economic growth and increase government debt servicing costs. Keywords: interest rates Canada.

- Global Economic Uncertainty: Geopolitical instability and global economic slowdowns pose significant risks to the Canadian economy, impacting trade and investment. Keywords: global economic uncertainty.

- Aging Population: Canada's aging population presents challenges related to healthcare costs and the shrinking workforce, placing pressure on government finances.

- Healthcare Costs: The rising cost of healthcare is a significant strain on government budgets, requiring careful planning and resource allocation.

These challenges underscore the urgent need for prudent financial management and a commitment to fiscal responsibility in Canada.

H2: The Importance of Fiscal Responsibility in Canada

H3: Defining Fiscal Responsibility:

Fiscal responsibility in Canada, in the context of government policy, involves managing public finances in a sustainable and equitable manner. This entails:

- Careful planning and execution of government budgets. Keywords: government spending Canada, budget deficit Canada.

- Strategic debt management to ensure long-term solvency. Keywords: debt reduction Canada.

- Transparency and accountability in the use of public funds.

- Prioritization of spending based on evidence and societal needs.

- A commitment to a balanced budget or a manageable level of debt over the long term. Keywords: balanced budget Canada.

H3: Long-Term Benefits of Fiscal Responsibility:

Sound fiscal management yields significant long-term benefits for Canada:

- Lower interest rates: Reduced government debt can lead to lower interest rates, benefiting businesses and consumers. Keywords: economic stability Canada.

- Increased investor confidence: Responsible fiscal policy attracts foreign investment and strengthens the Canadian dollar. Keywords: investor confidence Canada.

- Improved credit rating: A strong fiscal position improves Canada's credit rating, reducing borrowing costs. Keywords: credit rating Canada.

- Reduced risk of economic crises: Sound financial management helps mitigate the risk of financial instability and economic shocks.

- Sustainable economic growth: Fiscal responsibility creates a stable economic environment conducive to sustainable growth.

H2: Strategies for Achieving Fiscal Responsibility

H3: Government Spending Review and Prioritization:

A comprehensive review of government spending is essential to identify areas for efficiency improvements and reallocation of funds. This involves:

- Program evaluation: Rigorous evaluation of existing programs to determine their effectiveness and cost-efficiency. Keywords: government efficiency Canada, program evaluation Canada.

- Identifying overlapping programs: Consolidating or eliminating redundant programs to reduce duplication.

- Prioritizing essential services: Focusing resources on core public services and addressing urgent societal needs. Keywords: public spending Canada.

H3: Revenue Generation and Tax Policy:

Exploring options for increasing government revenue is crucial for achieving fiscal sustainability:

- Reviewing tax policies: Ensuring a fair and efficient tax system that maximizes revenue collection while minimizing administrative burdens. Keywords: tax policy Canada, tax reform Canada.

- Addressing tax evasion: Implementing measures to combat tax evasion and avoidance. Keywords: tax revenue Canada.

- Exploring new revenue streams: Considering options such as carbon taxes or other environmentally-focused revenue generation.

H3: Investing in Long-Term Growth:

Strategic investments in key areas are vital for fostering long-term economic growth and fiscal sustainability:

- Infrastructure investment: Investing in critical infrastructure projects to improve productivity and economic competitiveness. Keywords: infrastructure investment Canada.

- Education funding: Investing in education and skills development to enhance the workforce and promote innovation. Keywords: education funding Canada.

- Technology investment: Supporting research and development in key technological sectors to drive innovation and economic diversification. Keywords: technology investment Canada.

These investments, while requiring upfront spending, contribute significantly to long-term economic growth and fiscal sustainability.

3. Conclusion:

Achieving fiscal responsibility in Canada is not merely a matter of prudent bookkeeping; it's the cornerstone of a strong and prosperous future. The challenges facing the Canadian economy, including inflation, high interest rates, and global uncertainty, underscore the urgency of adopting responsible fiscal practices. Strategies such as reviewing government spending, optimizing revenue generation, and investing strategically in long-term growth are essential to navigate these challenges and ensure a stable and prosperous future. Demand fiscal responsibility from your government, learn more about fiscal responsibility in Canada, and support policies promoting fiscal responsibility. The economic well-being of all Canadians depends on it.

Featured Posts

-

Columbia University Students Plea To Attend Sons Birth Rejected By Ice

Apr 24, 2025

Columbia University Students Plea To Attend Sons Birth Rejected By Ice

Apr 24, 2025 -

Instagrams Bid For Tik Tok Creators A New Video Editing Tool

Apr 24, 2025

Instagrams Bid For Tik Tok Creators A New Video Editing Tool

Apr 24, 2025 -

Sharp Drop In Teslas Q1 Profits Musks Political Involvement Takes A Toll

Apr 24, 2025

Sharp Drop In Teslas Q1 Profits Musks Political Involvement Takes A Toll

Apr 24, 2025 -

How Middle Managers Contribute To A Thriving Company Culture And High Performing Teams

Apr 24, 2025

How Middle Managers Contribute To A Thriving Company Culture And High Performing Teams

Apr 24, 2025 -

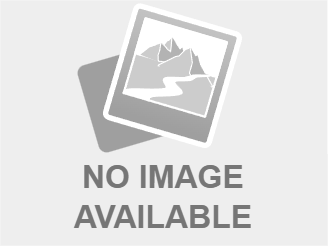

Open Ai 2024 Streamlined Voice Assistant Creation For Developers

Apr 24, 2025

Open Ai 2024 Streamlined Voice Assistant Creation For Developers

Apr 24, 2025