BofA's Reassuring View: Are High Stock Market Valuations Really A Worry?

Table of Contents

BofA's Key Arguments Against Excessive Valuation Concerns

BofA's analysts present several arguments to downplay the perceived risks associated with current high stock market valuations. Their reasoning rests on a combination of strong corporate fundamentals, supportive monetary policy, and a positive outlook for long-term economic growth.

Strong Corporate Earnings Growth

BofA highlights robust corporate earnings growth as a key justification for higher valuations. Their report points to several factors:

- Projected Earnings Growth: BofA projects an average earnings growth rate of X% for the S&P 500 in the next year (replace X with actual data from BofA's report if available). This surpasses historical averages and indicates a strong underlying foundation for current stock prices.

- Sector-Specific Performance: Specific sectors, such as technology and consumer discretionary, are showing particularly strong earnings growth, fueled by innovation and increased consumer spending.

- Improved Profit Margins: Many companies are experiencing improved profit margins due to increased efficiency and pricing power, further bolstering earnings growth.

These factors suggest that current valuations, while seemingly high, are supported by strong underlying corporate profitability. The sustained growth in earnings is a crucial element in determining whether the market is overvalued or not, offering a counter-narrative to the fear surrounding high stock market valuations. This positive outlook counters the narrative of an imminent market correction solely based on high price-to-earnings ratios.

Low Interest Rates and Abundant Liquidity

The current low-interest-rate environment and the abundant liquidity in the market play a significant role in supporting higher stock valuations.

- Near-Zero Interest Rates: The historically low interest rates make bonds and other fixed-income investments less attractive, driving capital towards riskier assets like stocks.

- Easy Access to Credit: The readily available credit fuels further investment in the stock market, boosting demand and supporting higher prices.

- Increased Investor Risk Appetite: Low interest rates encourage investors to take on more risk, leading to a higher willingness to pay premiums for growth stocks.

This readily available capital, fueled by low interest rates, is directly impacting investor behavior. The resulting increased demand pushes up stock prices, creating a scenario where seemingly high valuations are, to a certain extent, a byproduct of monetary policy.

Long-Term Growth Potential

BofA emphasizes the long-term growth potential of the global economy as another factor supporting higher stock valuations. Their outlook includes:

- Technological Innovation: Continued advancements in technology, particularly in areas such as artificial intelligence and renewable energy, are expected to fuel significant growth in related sectors.

- Emerging Markets Growth: Developing economies are projected to experience strong growth, creating opportunities for international diversification and higher returns.

- Demographic Shifts: Changes in population demographics, including an aging population in developed countries and a growing working-age population in emerging markets, offer significant opportunities for certain sectors.

The long-term perspective is critical in evaluating high stock market valuations. Focusing solely on short-term fluctuations can obscure the significant growth potential identified by BofA, showcasing a longer-term justification for seemingly high price tags.

Counterarguments and Potential Risks

While BofA presents a positive outlook, it's crucial to acknowledge potential counterarguments and risks.

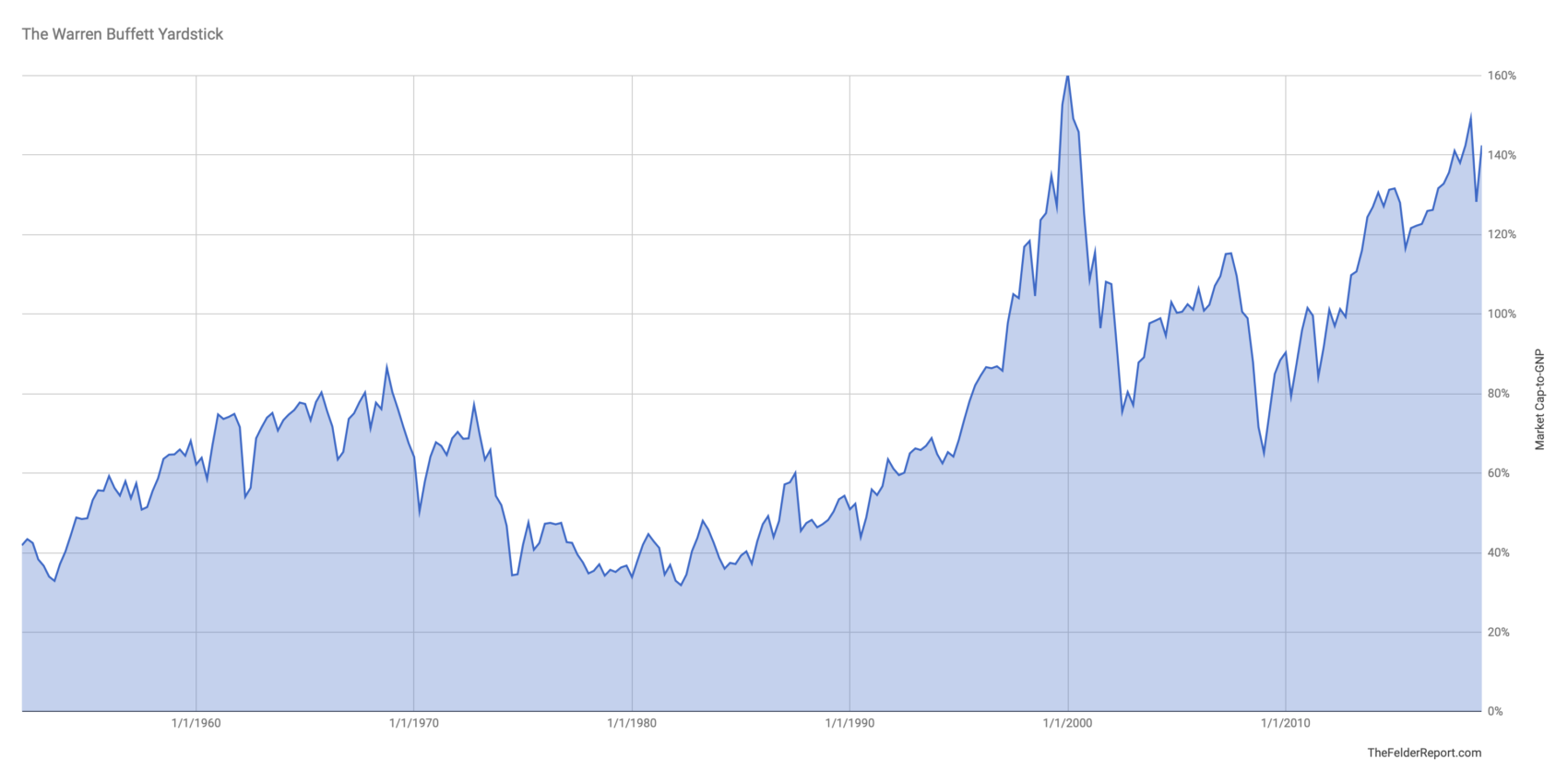

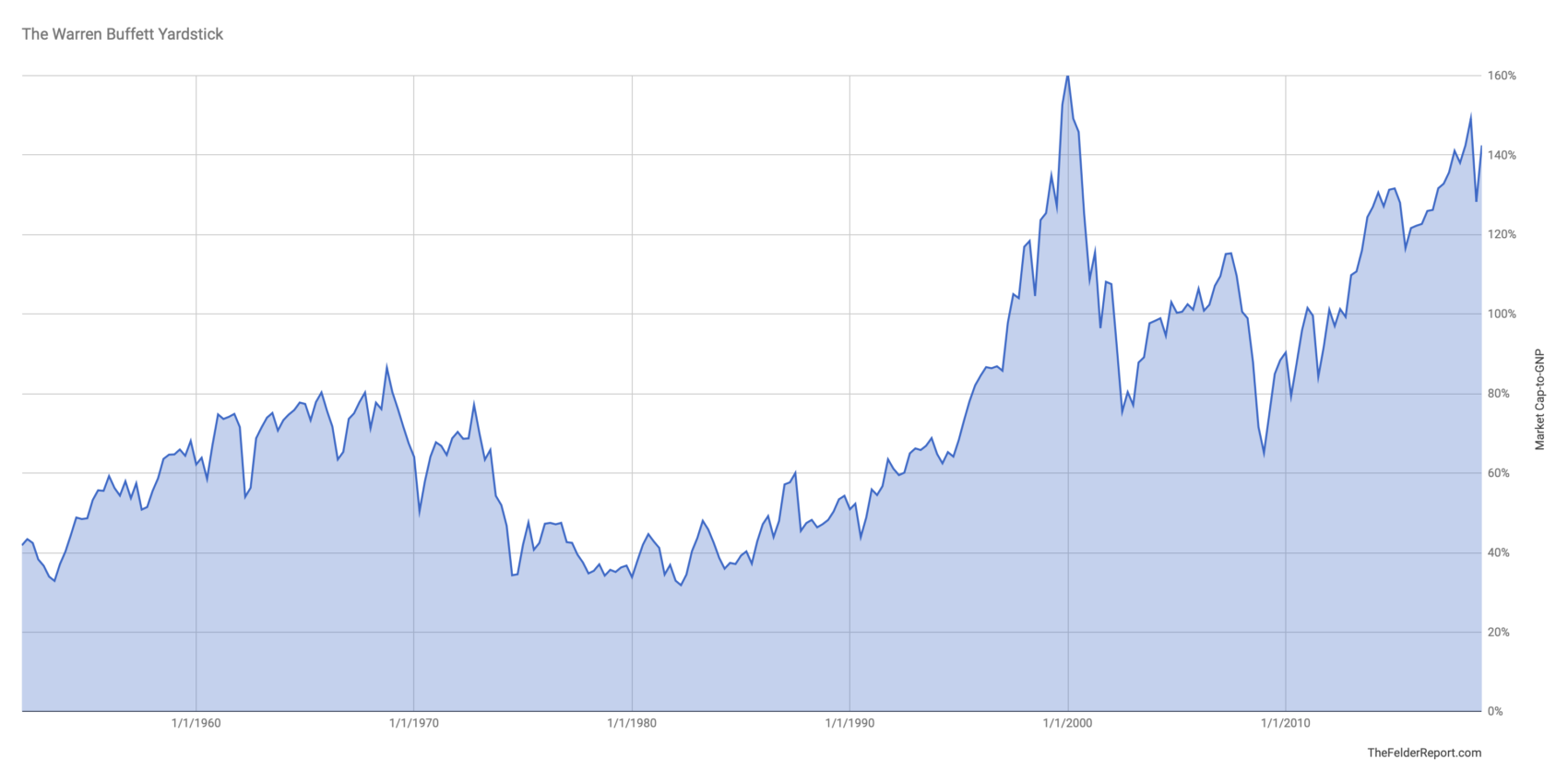

Valuation Metrics and Historical Comparisons

Some valuation metrics might paint a less optimistic picture than BofA's analysis.

- High P/E Ratios: Current P/E ratios for the S&P 500 are historically high compared to long-term averages.

- Other Valuation Metrics: Other metrics such as Price-to-Sales ratios and the Shiller P/E ratio (CAPE ratio) also indicate relatively high valuations.

It's important to note that historical comparisons have limitations. Past performance isn't necessarily indicative of future results, and current macroeconomic conditions might differ significantly from previous periods with similar valuation levels. Analyzing various valuation metrics, alongside the BofA report, is crucial for a well-rounded picture of the market's valuation.

Geopolitical and Economic Uncertainty

Significant uncertainties could impact stock valuations negatively.

- Inflationary Pressures: Rising inflation could erode corporate profits and lead to higher interest rates, potentially cooling down the market.

- Geopolitical Instability: Global conflicts and political uncertainties can significantly impact investor sentiment and market stability.

- Supply Chain Disruptions: Ongoing supply chain issues could negatively impact corporate earnings and overall economic growth.

Understanding these potential risks is crucial to building a robust investment strategy. A thorough assessment of these risks should guide any decisions concerning investment portfolios that are affected by high stock market valuations.

Investor Strategies in a High-Valuation Environment

Navigating a market with high stock market valuations requires a strategic approach.

Diversification and Risk Management

Diversification is crucial to mitigate risk.

- Asset Class Diversification: Spread investments across different asset classes, such as stocks, bonds, and real estate, to reduce exposure to any single market's volatility.

- Sector Diversification: Diversify investments across various sectors to minimize the impact of underperformance in any single sector.

- Geographic Diversification: Investing in international markets can further diversify risk and provide access to potentially higher growth opportunities.

The fundamental principle of diversification helps manage the risk inherent in a market potentially characterized by high valuations. A diversified portfolio acts as a buffer against potential market downturns, shielding investors from substantial losses.

Long-Term Investing Approach

A long-term perspective is essential.

- Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market fluctuations, to mitigate the risk of investing a large sum at a market peak.

- Disciplined Investing: Maintain a disciplined investment plan and avoid impulsive reactions to short-term market movements.

A long-term investment strategy that emphasizes consistent investing over time can mitigate the impact of market fluctuations and ultimately increase the likelihood of achieving long-term financial goals.

Conclusion: Navigating High Stock Market Valuations – BofA's Perspective and Your Next Steps

BofA's analysis presents a relatively optimistic view on high stock market valuations, citing strong earnings growth, supportive monetary policy, and long-term growth potential. However, potential counterarguments, such as historically high valuation metrics and the presence of significant geopolitical and economic uncertainties, must be carefully considered. Understanding both perspectives is crucial for a comprehensive assessment.

The key takeaway is that while high stock market valuations are a valid concern, they don't necessarily signal an imminent market crash. A balanced approach that considers both the optimistic and pessimistic perspectives is essential. Investors should adopt a diversified, long-term investment strategy, carefully managing risk and aligning their approach with their individual risk tolerance and financial goals.

Before making any investment decisions based on BofA's analysis or any other single source, conduct thorough research and consult with a qualified financial advisor. Understanding high stock market valuations and their implications for your personal portfolio is crucial for making informed investment choices.

Featured Posts

-

Anchor Brewings Closure A Legacy In Beer Comes To An End

Apr 26, 2025

Anchor Brewings Closure A Legacy In Beer Comes To An End

Apr 26, 2025 -

Orlandos Best New Restaurants 7 Spots To Explore In 2025

Apr 26, 2025

Orlandos Best New Restaurants 7 Spots To Explore In 2025

Apr 26, 2025 -

Abb Vies Q Quarter Earnings Upbeat Guidance Driven By New Drug Sales

Apr 26, 2025

Abb Vies Q Quarter Earnings Upbeat Guidance Driven By New Drug Sales

Apr 26, 2025 -

Bullions Rise Amidst Trade Wars A Deep Dive Into Gold Price Records

Apr 26, 2025

Bullions Rise Amidst Trade Wars A Deep Dive Into Gold Price Records

Apr 26, 2025 -

2700 Miles Away How Trumps First 100 Days Affected A Rural School

Apr 26, 2025

2700 Miles Away How Trumps First 100 Days Affected A Rural School

Apr 26, 2025