Bitcoin (BTC) Rises Amidst Trade And Federal Reserve Uncertainty

Table of Contents

The Impact of Trade Tensions on Bitcoin (BTC)

Escalating trade tensions between major global economies, such as the ongoing US-China trade discussions, often create significant geopolitical risk and uncertainty in traditional markets. During these times, investors often seek safe-haven assets to protect their portfolios from potential losses. Bitcoin, as a decentralized and independent asset, is increasingly viewed as a hedge against this geopolitical uncertainty.

- Safe Haven Appeal: The decentralized nature of Bitcoin, independent of any single government or institution, makes it attractive during times of political and economic instability.

- Increased Demand: Increased demand for Bitcoin during periods of trade instability directly pushes prices upwards, as investors seek to diversify their holdings and protect against potential currency devaluation.

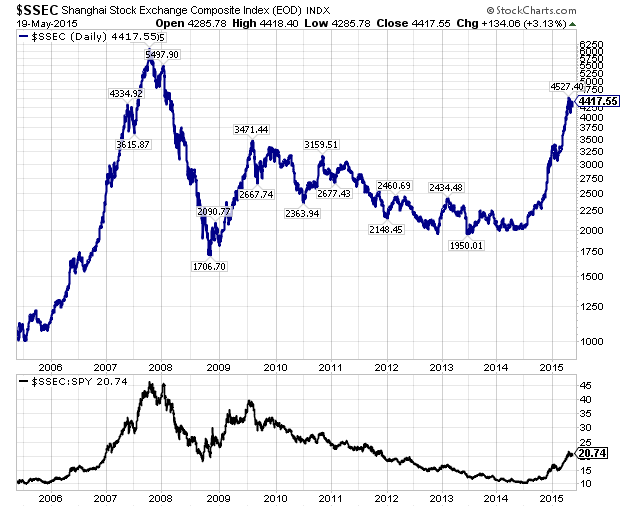

- Historical Data: Analysis of historical data reveals a notable correlation between periods of heightened trade disputes and subsequent increases in Bitcoin's market cap and price. This suggests a growing recognition of Bitcoin as a safe haven asset.

- Digital Gold: Many analysts view Bitcoin as a form of "digital gold," mirroring the traditional role of gold as a safe haven asset during times of economic turmoil. This perception contributes significantly to its price appreciation during periods of uncertainty.

The Federal Reserve's Influence on Bitcoin (BTC) Price

The Federal Reserve's decisions regarding interest rates and monetary policy significantly impact the US dollar and, consequently, global financial markets. These actions ripple across traditional and digital assets, influencing Bitcoin price volatility.

- Interest Rates and Dollar Devaluation: Lower interest rates can lead to dollar devaluation, making alternative assets like Bitcoin relatively more attractive. This can fuel increased demand and subsequently drive Bitcoin's price higher.

- Monetary Policy Uncertainty: Uncertainty surrounding future Federal Reserve actions creates volatility in both traditional and cryptocurrency markets. Predicting the Fed's next move is difficult, making investing in any asset – including Bitcoin – inherently risky.

- Correlation Analysis: While not always perfectly linear, studies show a correlation between changes in interest rates and Bitcoin price fluctuations. Understanding these correlations is crucial for informed investment strategies.

- Regulatory Clarity: The Federal Reserve's stance on cryptocurrency regulation also significantly impacts Bitcoin adoption and price. Increased regulatory clarity can boost investor confidence, whereas uncertainty can lead to price dips.

Quantitative Easing and its Effect on Bitcoin

Quantitative easing (QE), a monetary policy tool used to increase the money supply, can lead to inflation. This is where Bitcoin, with its fixed supply of 21 million coins, is increasingly viewed as an inflation hedge.

- Inflation Hedge: Unlike fiat currencies, Bitcoin's limited supply makes it potentially resistant to inflationary pressures. As the money supply grows through QE, the value of Bitcoin may increase relative to depreciating fiat currencies.

- Historical Relationship: Examining historical data reveals a potential correlation between periods of QE and subsequent Bitcoin price appreciation. However, other factors also influence the price, making it difficult to isolate QE as the sole driver.

- Investment Strategies: Understanding the interplay between QE, inflation, and Bitcoin's price movements can inform long-term investment strategies. Investors can consider Bitcoin as part of a diversified portfolio designed to mitigate inflation risk.

Increased Institutional Interest in Bitcoin (BTC)

The growing participation of institutional investors, such as hedge funds and large asset management firms, in the Bitcoin market is a significant factor driving its price. This institutional adoption adds legitimacy and increases market liquidity.

- Grayscale and Others: Firms like Grayscale Investments have played a significant role in driving Bitcoin's price through their substantial investments in Bitcoin and other cryptocurrencies.

- Bitcoin ETFs: The potential introduction of Bitcoin exchange-traded funds (ETFs) could further increase market liquidity and accessibility, potentially leading to substantial price appreciation.

- Long-Term Implications: The long-term implications of institutional adoption are significant. It suggests a growing acceptance of Bitcoin as a viable asset class, boosting its credibility and potential for long-term growth.

Conclusion

The recent rise in Bitcoin (BTC) price is a result of several interconnected factors, including escalating trade tensions, uncertainty surrounding Federal Reserve monetary policy, and the increasing interest from institutional investors. These elements highlight Bitcoin's growing role as a potential safe-haven asset and a hedge against economic uncertainty.

Understanding the complex interplay between global economics and Bitcoin (BTC) is crucial for navigating the cryptocurrency market. Stay informed about the latest developments and consider diversifying your investment portfolio with Bitcoin, but remember to proceed with caution and conduct thorough research before investing in any cryptocurrency. Learn more about Bitcoin (BTC) and its potential today!

Featured Posts

-

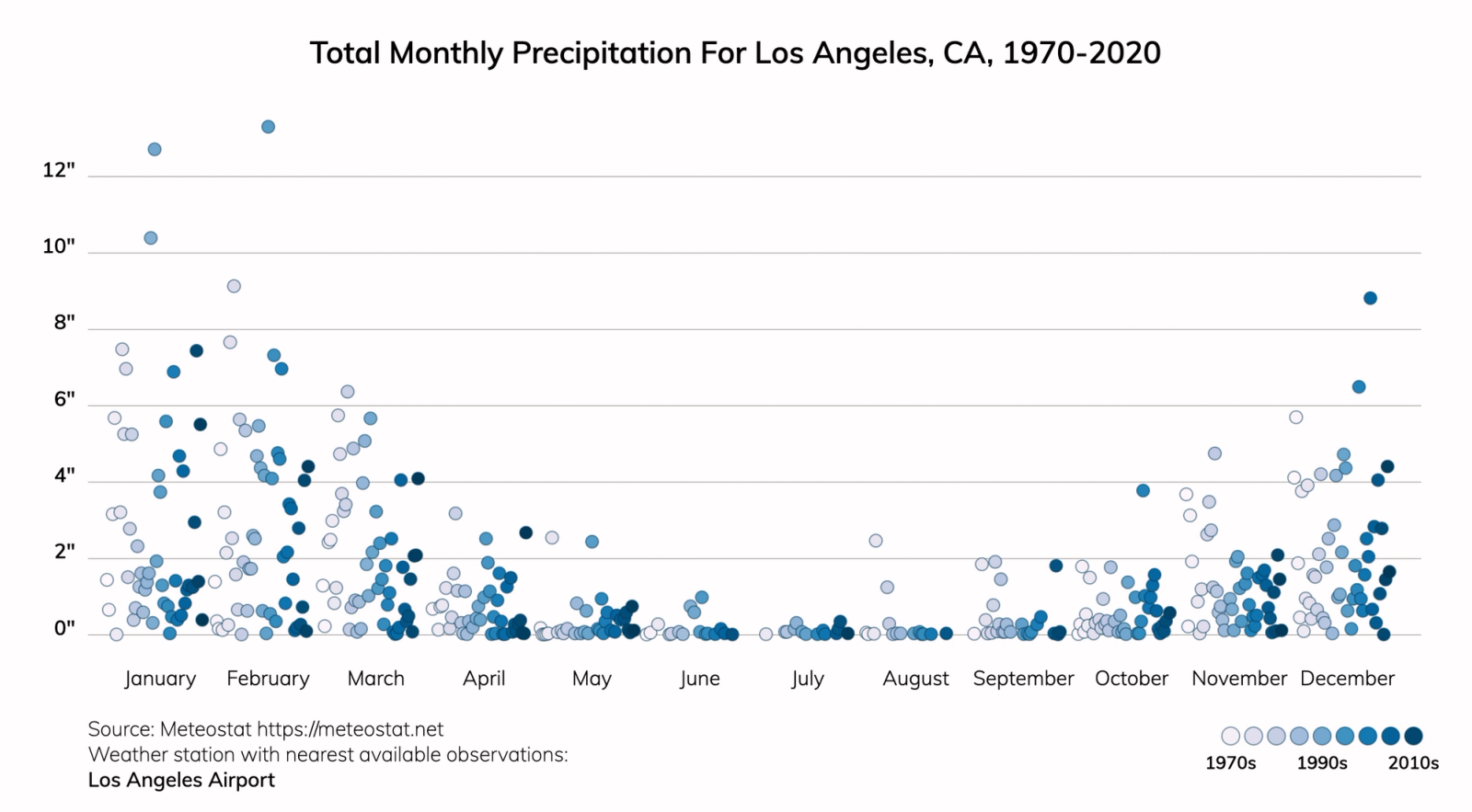

The Los Angeles Wildfires And The Perilous Trend Of Betting On Natural Disasters

Apr 24, 2025

The Los Angeles Wildfires And The Perilous Trend Of Betting On Natural Disasters

Apr 24, 2025 -

Chinese Stocks Listed In Hong Kong See Significant Gains

Apr 24, 2025

Chinese Stocks Listed In Hong Kong See Significant Gains

Apr 24, 2025 -

Fiscal Responsibility A Missing Element In Canadas Liberal Vision

Apr 24, 2025

Fiscal Responsibility A Missing Element In Canadas Liberal Vision

Apr 24, 2025 -

Sharks And A Death The Israeli Beach Where Tourists Once Flocked

Apr 24, 2025

Sharks And A Death The Israeli Beach Where Tourists Once Flocked

Apr 24, 2025 -

77 Inch Lg C3 Oled Performance And Features

Apr 24, 2025

77 Inch Lg C3 Oled Performance And Features

Apr 24, 2025