Bitcoin (BTC) Price Surge: Trump's Actions And Fed Policy Impact

Table of Contents

Trump's Influence on Bitcoin (BTC) Price Volatility

Former President Trump's pronouncements and actions have consistently shown the potential to move markets, and Bitcoin is no exception. His influence can be seen through two primary lenses: his social media impact on market sentiment and the effect of political uncertainty on Bitcoin's role as a safe-haven asset.

Social Media Impact and Market Sentiment

Trump's frequent use of social media platforms has a demonstrable impact on various markets, including cryptocurrency. His tweets and posts, often offering opinions on various topics, can significantly sway investor sentiment.

- Example 1: A positive tweet about Bitcoin or cryptocurrency in general could lead to a rapid price increase as investors rush to buy.

- Example 2: Conversely, a negative comment or criticism could trigger a sell-off, causing the Bitcoin price to plummet.

The unpredictable nature of his statements makes it challenging to predict the market's reaction, further contributing to Bitcoin's volatility. This unpredictable nature makes "Trump Bitcoin" a frequently searched term, highlighting the direct link between his actions and the cryptocurrency's price. His pronouncements create a ripple effect, shaping market sentiment and directly impacting the price of Bitcoin and other cryptocurrencies. This creates a constant state of flux, making the market susceptible to sudden, significant changes, emphasizing the importance of tracking "Trump cryptocurrency" news for any Bitcoin investor.

Political Uncertainty and Safe-Haven Asset Status

Political uncertainty, often exacerbated by Trump's actions and statements, can lead investors to seek alternative assets perceived as safe havens. Bitcoin, with its decentralized nature and independence from traditional financial systems, has increasingly been viewed as a hedge against political instability and economic turmoil.

- Investors may flock to Bitcoin during periods of heightened political risk, driving up its price.

- This influx of capital seeking refuge from uncertainty can create a surge in demand, increasing the Bitcoin price.

The perception of Bitcoin as a "Bitcoin safe haven" asset is amplified during periods of heightened political risk, thereby strengthening its price. Understanding the interplay between "political uncertainty Bitcoin" and the cryptocurrency's price is key to navigating this volatile market. The relationship between "inflation hedge Bitcoin" and political unrest further solidifies this perception. Data analysis showing Bitcoin price movements during periods of political instability supports this argument.

The Federal Reserve's Monetary Policy and its Effect on Bitcoin (BTC)

The Federal Reserve's monetary policy plays a crucial role in shaping the global economic landscape, and its impact on Bitcoin is significant, albeit indirect. Two key aspects of this policy – interest rate hikes and quantitative easing (QE) – have a considerable effect on Bitcoin's price.

Interest Rate Hikes and Bitcoin's Inverse Correlation

Interest rate hikes by the Fed typically lead to a strengthening of the US dollar and increased returns on traditional assets like bonds. This often results in a decrease in investor appetite for riskier assets, including Bitcoin.

- Higher interest rates can reduce the attractiveness of Bitcoin as an investment, leading to a decline in its price.

- Historical data on interest rate changes and their correlation with Bitcoin prices consistently demonstrates this inverse relationship. Analyzing "Bitcoin interest rates" is crucial for understanding market dynamics.

The effect of "Fed policy Bitcoin" is complex, and it's essential to note that while a correlation exists, it's not always straightforward. Market sentiment and other factors can modify this relationship. This analysis heavily relies on data related to "Bitcoin inflation" and its relation to the Fed's actions.

Quantitative Easing and Bitcoin's Growth

Quantitative easing (QE), a monetary policy tool involving the injection of large amounts of money into the financial system, can have the opposite effect.

- QE can lead to inflation and weaken the value of fiat currencies, potentially increasing Bitcoin's appeal as a store of value.

- The potential impact of future QE policies on Bitcoin's price is a subject of ongoing discussion and analysis, with the search term "Quantitative easing Bitcoin" reflecting investor interest in this topic.

The understanding of "Bitcoin QE" and its relation to price movements is crucial for investors looking to navigate the market effectively.

The Interplay Between Trump's Actions and Fed Policy on Bitcoin (BTC)

The influence of Trump's actions and the Fed's policy on Bitcoin's price are not mutually exclusive. They interact in complex ways, creating a volatile market environment. For instance, increased political uncertainty fueled by Trump's actions, combined with a tightening monetary policy by the Fed, could create a perfect storm for bearish pressure on Bitcoin.

- A confluence of these factors can lead to increased market volatility.

- Conversely, periods of relative political calm coupled with expansionary monetary policy could create a more bullish environment.

Analyzing the "Bitcoin correlation" between these two factors using charts and graphs is vital for developing informed investment strategies. The relationship between "Trump Fed Bitcoin" offers a complex yet insightful picture of market dynamics. Understanding "Bitcoin market analysis" that incorporates these intertwined factors is crucial for effective decision-making.

Conclusion

The recent Bitcoin (BTC) price surge highlights the complex interplay of political and economic factors influencing the cryptocurrency market. Former President Trump's actions, impacting market sentiment and fostering a safe haven demand for Bitcoin, played a significant role, as did the Federal Reserve's monetary policy, impacting investor appetite for risk assets. The interplay between "Trump Fed Bitcoin" created a volatile landscape.

The key takeaway is that understanding both political and economic developments is essential for navigating the volatile Bitcoin market. Fluctuations in "Bitcoin interest rates" and the impact of "Quantitative easing Bitcoin" must be tracked alongside the implications of "Trump Bitcoin" news.

Understanding the impact of factors like Trump's actions and the Fed's policy on the Bitcoin (BTC) price surge is crucial for informed investment decisions. Stay updated on market trends to make sound choices in this dynamic environment.

Featured Posts

-

Trump Reassures Markets No Plans To Dismiss Fed Chair Powell

Apr 24, 2025

Trump Reassures Markets No Plans To Dismiss Fed Chair Powell

Apr 24, 2025 -

Saudi Arabia And India To Build Two Joint Oil Refineries

Apr 24, 2025

Saudi Arabia And India To Build Two Joint Oil Refineries

Apr 24, 2025 -

Where To Invest A Geographic Analysis Of The Countrys Top Business Locations

Apr 24, 2025

Where To Invest A Geographic Analysis Of The Countrys Top Business Locations

Apr 24, 2025 -

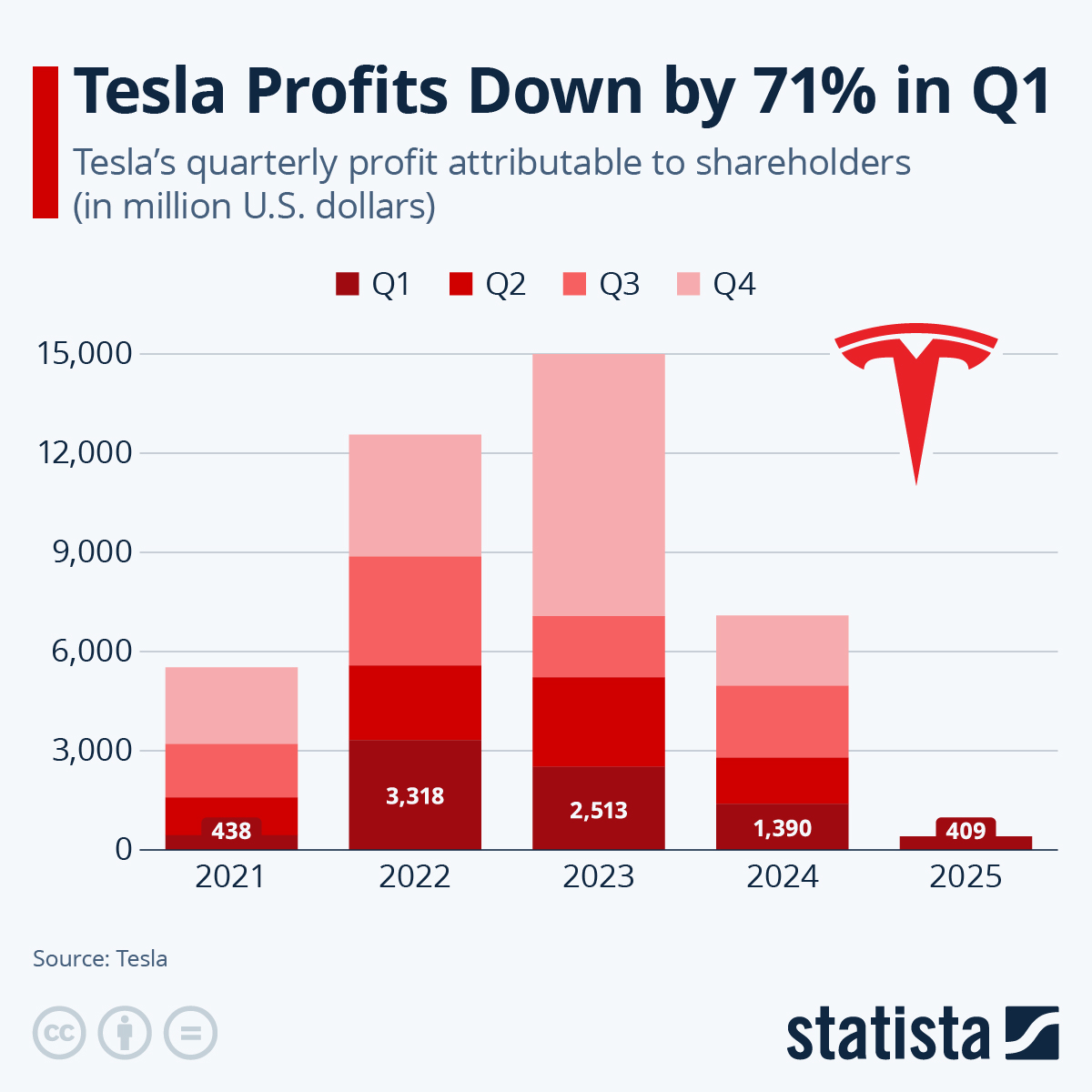

Tesla Q1 Earnings Report Analyzing The Impact Of Musks Actions

Apr 24, 2025

Tesla Q1 Earnings Report Analyzing The Impact Of Musks Actions

Apr 24, 2025 -

California Gas Prices Governor Newsom Seeks Industry Collaboration To Ease Burden

Apr 24, 2025

California Gas Prices Governor Newsom Seeks Industry Collaboration To Ease Burden

Apr 24, 2025