Are Los Angeles Wildfires Becoming A Gambling Market? The Implications For Society

Table of Contents

The Rise of Wildfire Prediction Markets and Their Risks

The emergence of prediction markets forecasting wildfire severity and location raises serious ethical questions. These markets, where individuals bet on the likelihood and intensity of wildfires, create a perverse incentive to profit from a natural disaster. The very act of predicting and potentially profiting from devastation raises significant ethical concerns.

-

Examples of existing (or hypothetical) prediction markets: While formal, regulated markets predicting wildfire specifics in Los Angeles are currently absent, the concept is not new. Similar models exist for predicting other events, and the application to wildfires is a disturbing possibility. Hypothetically, a market could exist where participants bet on the acreage burned, the number of structures destroyed, or even the specific location of a major wildfire.

-

Potential for manipulation and misinformation influencing these markets: The accuracy of these predictions is crucial, and the potential for manipulation and the spread of misinformation is significant. False information, whether intentional or accidental, could artificially inflate or deflate market values, leading to unfair gains for some and losses for others.

-

The vulnerability of communities already impacted by wildfires: The most vulnerable are those directly impacted by the wildfires. Their suffering is compounded by the knowledge that others are potentially profiting from their misfortune. This raises questions about social justice and the ethical responsibilities of those involved in these markets.

-

Regulatory challenges in overseeing these emerging markets: The regulatory landscape surrounding these nascent markets is largely uncharted territory. Governments face the challenge of creating frameworks that both prevent exploitation and allow for legitimate risk assessment and mitigation.

Insurance Companies and the Wildfire Gamble

Insurance companies play a critical role in assessing and managing wildfire risk. However, their involvement can also be seen as a form of gambling, albeit a highly regulated one. As wildfire risk increases, so do insurance premiums, and in some high-risk areas, coverage is becoming increasingly difficult to obtain.

-

Discussion of actuarial models used by insurance companies: Insurance companies rely on complex actuarial models to predict future wildfire losses. These models factor in climate change, historical data, and other variables. However, the increasing frequency and intensity of wildfires are challenging these models, leading to increased uncertainty and higher premiums.

-

The impact of climate change on insurance payouts and risk assessment: Climate change is a key driver of increased wildfire risk. The resulting increase in payouts forces insurance companies to reassess their risk profiles and adjust premiums accordingly, often making insurance unaffordable for many residents.

-

The potential for insurance fraud related to wildfires: The chaotic aftermath of wildfires creates opportunities for insurance fraud. Inflated claims and fraudulent applications strain the system and increase the cost of insurance for everyone.

-

The financial burden on individuals and communities due to rising insurance costs: Rising insurance premiums are placing a significant financial burden on individuals and communities, especially in areas prone to wildfires. This burden disproportionately affects low-income households, further exacerbating existing inequalities.

The Impact on Real Estate and Investment

Wildfire risk significantly impacts property values and investment decisions in Los Angeles. The potential for speculative buying and selling based on wildfire risk creates another layer of complexity within the “Los Angeles Wildfires Gambling Market”.

-

The influence of wildfire risk on property appraisal and mortgages: Lenders and appraisers now factor wildfire risk into their assessments, leading to lower valuations and making it harder for homeowners to secure mortgages or refinance their properties.

-

The impact on the real estate market in areas prone to wildfires: The real estate market in wildfire-prone areas is becoming increasingly volatile. Property values can fluctuate dramatically depending on the perceived risk, creating uncertainty for buyers and sellers.

-

Potential for investors to capitalize on post-wildfire rebuilding efforts: Some investors see opportunities to capitalize on post-wildfire rebuilding efforts. This can lead to increased property prices and displacement of existing residents who may not be able to afford to return to their homes.

-

Ethical considerations related to real estate investment in high-risk areas: The ethical implications of investing in high-risk areas are significant. Profiting from rebuilding efforts while ignoring the underlying issues of wildfire risk raises important questions about social responsibility.

The Socioeconomic Disparities Exacerbated by Wildfire Speculation

Wildfire speculation disproportionately affects vulnerable populations. Low-income communities and communities of color often lack the resources to adequately prepare for or recover from wildfires. They may have limited access to insurance, disaster relief, and other support systems.

-

Impact on low-income communities and communities of color: These communities are often located in areas with increased wildfire risk, yet they have less access to resources that would help them mitigate the impact.

-

Lack of access to adequate insurance or disaster relief: Many residents in these communities lack adequate insurance coverage or struggle to access disaster relief funds.

-

Increased displacement and housing insecurity: Wildfires can lead to widespread displacement and housing insecurity, disproportionately impacting low-income communities.

-

The need for equitable policies to mitigate the impacts of wildfires: Addressing the socioeconomic disparities requires equitable policies that ensure everyone has access to resources and support, regardless of their income or background.

Conclusion

The increasing monetization of Los Angeles wildfires raises serious ethical and societal concerns. From prediction markets to the insurance industry and real estate investment, there are numerous ways in which individuals and entities are potentially profiting from disaster. This trend exacerbates existing inequalities and undermines efforts towards community resilience. This "Los Angeles Wildfires Gambling Market," if left unchecked, will continue to inflict disproportionate harm.

We must move beyond simply reacting to these devastating events and address the underlying issues driving the “Los Angeles Wildfires Gambling Market.” This requires a multi-pronged approach involving stricter regulations, improved risk assessment, equitable insurance policies, and responsible investment practices. Only by acknowledging and addressing this complex problem can we hope to build a more resilient and just future for Los Angeles and other wildfire-prone regions. Let’s work together to prevent the Los Angeles wildfires from becoming a lucrative market for some at the expense of many.

Featured Posts

-

Chinas Lpg Imports The Rise Of Middle Eastern Suppliers And The Decline Of Us Imports

Apr 24, 2025

Chinas Lpg Imports The Rise Of Middle Eastern Suppliers And The Decline Of Us Imports

Apr 24, 2025 -

Bethesdas Oblivion Remastered Officially Released Today

Apr 24, 2025

Bethesdas Oblivion Remastered Officially Released Today

Apr 24, 2025 -

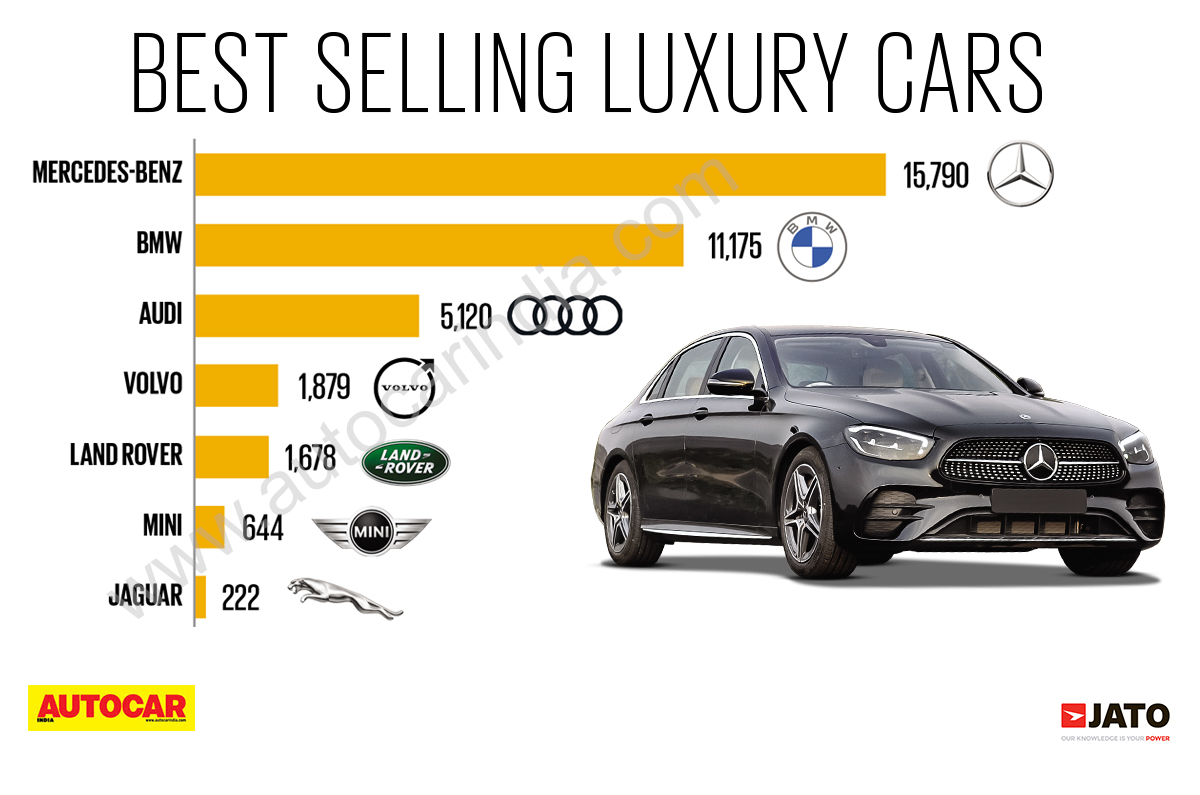

Chinas Impact On Luxury Car Sales Bmw Porsche And Beyond

Apr 24, 2025

Chinas Impact On Luxury Car Sales Bmw Porsche And Beyond

Apr 24, 2025 -

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 24, 2025

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 24, 2025 -

Price Gouging Allegations Surface In La Following Devastating Fires

Apr 24, 2025

Price Gouging Allegations Surface In La Following Devastating Fires

Apr 24, 2025