Are High Stock Market Valuations A Concern? BofA Says No. Here's Why.

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Problem

BofA's optimistic stance on high stock market valuations rests on several key arguments. They contend that the current high price-to-earnings ratios (P/E ratios), often used as a measure of market valuation, aren't necessarily indicative of an impending market crash. Their reasoning hinges on several factors:

-

Low Interest Rates Supporting Higher P/E Ratios: Historically low interest rates make borrowing cheaper for companies, supporting higher valuations. When the cost of capital is low, investors are willing to pay more for future earnings. This lowers the discount rate applied to future cash flows, resulting in higher present values and thus higher stock prices. This environment encourages investment and fuels stock market growth, potentially justifying higher P/E ratios.

-

Strong Corporate Earnings Growth Exceeding Inflation: BofA points to robust corporate earnings growth as a key factor. Many companies have demonstrated resilience, exceeding inflation and showing promising revenue streams. This sustained growth provides a solid foundation for supporting current stock prices, even at seemingly high valuations. Strong earnings provide a buffer against potential economic headwinds.

-

Continued Technological Innovation Driving Future Growth: Technological advancements continue to disrupt industries and create new growth opportunities. Investments in sectors like artificial intelligence, biotechnology, and renewable energy are driving significant innovation, creating long-term growth potential and justifying premium valuations for companies at the forefront of these advancements. This long-term outlook is a key component of BofA's optimistic assessment.

-

Positive Economic Outlook Contributing to Investor Confidence: A generally positive, albeit cautiously optimistic, economic outlook contributes significantly to investor confidence. This confidence translates into higher demand for stocks, further pushing up valuations. While risks remain, a generally positive outlook supports the continuation of the bull market, mitigating concerns about high market valuation.

Analyzing the Current Market Conditions: A Deeper Dive

While BofA's analysis provides valuable insight, a comprehensive understanding requires examining other factors contributing to high valuations:

-

Global Economic Growth and its Impact on Stock Prices: Global economic growth, particularly in emerging markets, contributes to increased demand for stocks. This global growth fuels corporate earnings, enhancing investor confidence and supporting higher valuations.

-

Inflationary Pressures and Their Effect on Market Valuation: Inflationary pressures can influence market valuations in complex ways. While inflation can erode purchasing power, it also sometimes leads to higher corporate earnings (if companies can pass on increased costs to consumers) and potentially higher interest rates, which could then affect stock valuations.

-

Geopolitical Risks and Their Influence on Investor Sentiment: Geopolitical events, such as international conflicts or trade tensions, significantly impact investor sentiment. Uncertainty stemming from these events can either increase or decrease stock valuations, depending on investor perception of the long-term impact.

-

The Role of Quantitative Easing and Monetary Policy: Central banks' monetary policies, including quantitative easing, directly influence market liquidity and interest rates, which can significantly impact stock market valuations. The availability of cheap credit influences investment and borrowing decisions, impacting stock market growth and valuations.

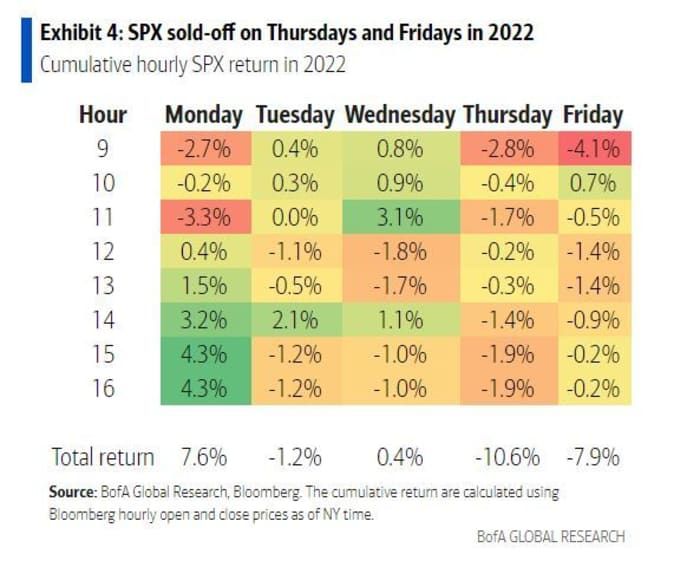

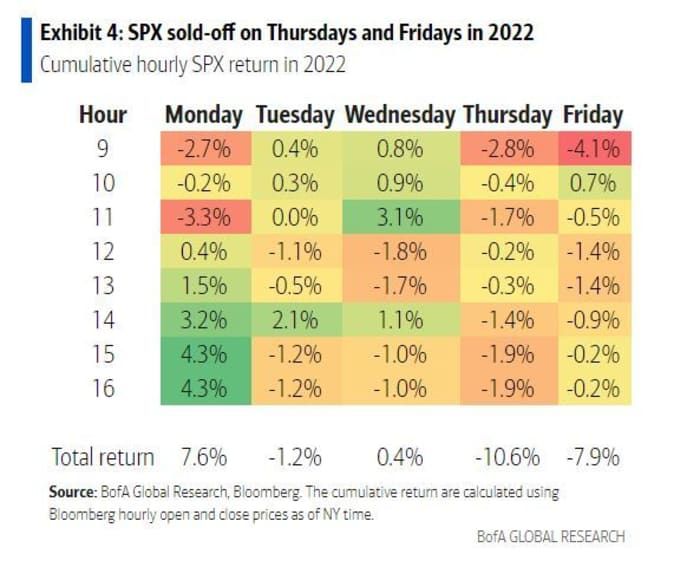

(Insert relevant chart or graph here visualizing market data, such as P/E ratios over time, or a comparison of earnings growth vs. inflation.)

Alternative Perspectives and Potential Risks

It's crucial to acknowledge counterarguments to BofA's optimistic view. High stock market valuations inherently carry risks:

-

The Potential for a Market Correction Due to Overvaluation: The risk of a market correction driven by overvaluation remains a significant concern for many investors. A sharp decline in prices could occur if investor sentiment shifts negatively or if fundamental economic conditions deteriorate.

-

Risks Associated with High Debt Levels in Some Sectors: High debt levels in certain sectors, particularly in the corporate bond market, present a potential risk. Rising interest rates could make it more difficult for companies to service their debt, leading to defaults and negatively affecting market valuations.

-

The Impact of Rising Interest Rates on Stock Prices: A rise in interest rates, intended to combat inflation, can impact stock valuations negatively. Higher interest rates increase the cost of borrowing, decreasing corporate profitability and making bonds a more attractive investment compared to stocks.

-

The Vulnerability of Certain Sectors to Economic Downturns: Some sectors are inherently more vulnerable to economic downturns. These sectors might experience disproportionately larger price drops during a market correction, impacting overall market valuations.

Developing a Robust Investment Strategy in a High-Valuation Environment

Navigating high stock market valuations requires a prudent investment strategy:

-

Diversification Across Different Asset Classes: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) helps mitigate risk. This strategy minimizes the impact of a potential decline in any single asset class.

-

Focus on Value Investing and Identifying Undervalued Companies: Value investing involves identifying companies trading below their intrinsic value. Thorough research is crucial to find undervalued stocks with strong long-term potential in a high-valuation market.

-

Regular Portfolio Rebalancing: Regularly rebalancing your portfolio ensures your asset allocation aligns with your risk tolerance and investment goals, mitigating the impact of market fluctuations.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon allows you to weather short-term market volatility and benefit from the long-term growth potential of the market.

-

Consider Professional Financial Advice: Consulting with a qualified financial advisor provides personalized guidance tailored to your individual circumstances and risk tolerance, especially in navigating complex market conditions like high valuations.

Conclusion

While BofA's optimistic outlook on high stock market valuations offers a compelling perspective, supported by factors like low interest rates and strong corporate earnings growth, it’s crucial to acknowledge the counterarguments. The potential for a market correction, the impact of rising interest rates, and sector-specific vulnerabilities remain valid concerns. The current market environment demands a nuanced approach, incorporating both optimism and a cautious awareness of potential risks.

High stock market valuations are a topic deserving careful consideration. Understanding the interplay of factors influencing market valuation is paramount for informed investment decisions. Continue researching the drivers of stock market valuation, consult with financial professionals, and develop a robust investment strategy that aligns with your risk tolerance. Don't let the fear of high stock market valuations paralyze you; instead, use this information to make smart, informed decisions about your investment portfolio.

Featured Posts

-

Building Voice Assistants Made Easy Key Takeaways From Open Ais 2024 Event

Apr 22, 2025

Building Voice Assistants Made Easy Key Takeaways From Open Ais 2024 Event

Apr 22, 2025 -

Is Google Facing Its Biggest Threat Yet A Potential Breakup

Apr 22, 2025

Is Google Facing Its Biggest Threat Yet A Potential Breakup

Apr 22, 2025 -

Analyzing The Potential Of A Joint Swedish Finnish Military Force

Apr 22, 2025

Analyzing The Potential Of A Joint Swedish Finnish Military Force

Apr 22, 2025 -

Exclusive Trump Administrations Plan To Defund Harvard By 1 Billion

Apr 22, 2025

Exclusive Trump Administrations Plan To Defund Harvard By 1 Billion

Apr 22, 2025 -

Closer Security Collaboration Between China And Indonesia

Apr 22, 2025

Closer Security Collaboration Between China And Indonesia

Apr 22, 2025